san francisco sales tax rate history

Fast Easy Tax Solutions. Sales Tax in San Francisco CA While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to.

Understanding California S Property Taxes

Ad Find Out Sales Tax Rates For Free.

. Notes to Rate History Table. SOLD MAY 20 2022. The 2018 United States Supreme Court decision in South Dakota v.

The transfer tax rate had been previously unchanged since 1967. Nearby homes similar to 640 Shotwell St have recently sold between 354K to 2625K at an average of 890 per square foot. The minimum combined 2022 sales tax rate for San Francisco California is.

This scorecard presents timely. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a. 1788 rows California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

To view a history of the statewide sales and use tax rate please. The estimated 2022 sales tax rate for 94080 is. Average Sales Tax With Local.

This is the total of state county and city sales tax rates. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their.

2022 List of California Local Sales Tax Rates. Payroll Expense Tax. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable.

Lowest sales tax NA Highest sales tax 1075 California Sales Tax. What is the sales tax rate in San Francisco California. Fast Easy Tax Solutions.

The total sales tax rate in any given location can be broken down into state county city and. For a list of your current and historical rates go to the. Has impacted many state nexus laws and sales tax collection.

The estimated 2022 sales tax rate for 94107 is. California City and County Sales and Use Tax Rates Rates Effective 04012017 through 06302017 1 P a g e Note. Rates are for total sales tax levied in the City County of San Francisco.

Next to city indicates incorporated city City. Has impacted many state nexus laws and sales tax collection. Higher sales tax than 89 of California localities -0375 lower than the maximum sales tax in CA The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax.

The 2018 United States Supreme Court decision in South Dakota v. This is the total of state county and city sales tax rates. Ad Find Out Sales Tax Rates For Free.

Proposition N passed in November 2010 created a new tax rate of 25 for transactions greater than or equal to 10. The Cannabis Business Tax rate can range as low as 1 and as high as 15 depending upon where you purchase legal marijuana across the state of California. California has state sales.

The California sales tax rate is currently 6. 21 rows History of Statewide Sales and Use Tax Rates The Bradley-Burns Uniform Local. These transactions had previously been taxed at the 075 rate.

The minimum combined 2022 sales tax rate for San Francisco California is 863.

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

California Sales Tax Rates By City County 2022

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

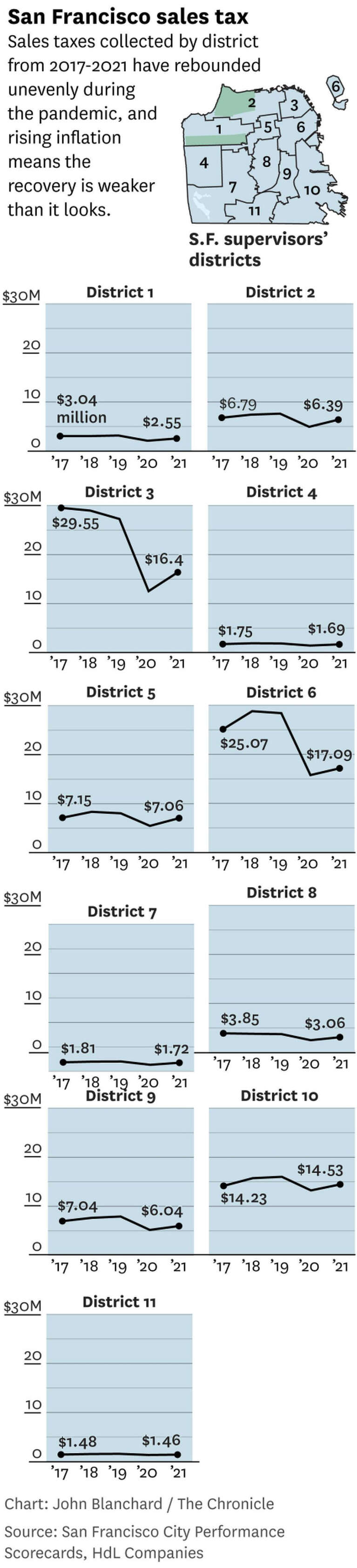

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

Understanding California S Property Taxes

Property Tax History Of Values Rates And Inflation Interactive Data Graphic Washington Department Of Revenue

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Sales Tax Collections City Performance Scorecards

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

How Do State And Local Sales Taxes Work Tax Policy Center

California Localities Extend Tax Relief To Marijuana Companies In Absence Of State Action

Frequently Asked Questions City Of Redwood City

California Taxpayers Association California Tax Facts

How Do State And Local Sales Taxes Work Tax Policy Center

Understanding California S Property Taxes